Original post by Omar Mohout via Whiteboard

With over 2,000 start-ups, 30 accelerators and 48,000 people employed in the digital economy, Silicon Roundabout in East London is the beating heart of the UK start-up scene, and Europe’s number one start-up hotspot, at least for the time being. This is, in part, thanks to David Cameron’s government.

Silicon Roundabout has grown organically, but since 2011 it has been actively promoted by the Cameron government as Tech City, headed by American former Facebook executive Joanna Shields.

Tech City, with abudget of £ 50M, has been working hard to attract big American players, such as Google, to London, following Dublin’s successful lead. And its efforts have not been in vain! With companies such as Facebook, Amazon, Microsoft (Yammer), Intel, Cisco and Qualcomm following in Google’s wake, London is establishing itself as the gateway to Europe. It also helps that Kickstarter has a London office allowing UK citizen’s & companies to participate in the gadget frenzy.

In addition to a mammoth PR campaign, the government has also introduced a number of tax incentives, such as lowering the tax rate for start-ups from 28% to 20%. Equally important has been the creation of the ‘Entrepreneur Visa’, making it easier to attract international talent into the country.

In addition to a mammoth PR campaign, the government has also introduced a number of tax incentives, such as lowering the tax rate for start-ups from 28% to 20%. Equally important has been the creation of the ‘Entrepreneur Visa’, making it easier to attract international talent into the country.

The success of the approach is clear to see, with the technology sector taking up more office space than the whole of the financial and insurance sector combined, and London now being one of the leading start-up cities in the world.

Google Campus

The focal point of the London tech scene is Google’s London Campus, home to two of the four biggest incubators: doyen Seedcamp and home-grown Oxygen.

Google Campus is a seven-storey building with co-working spaces for residents and visitors (TechHub), events rooms (free for anyone to use!) and a popular basement café with superfast WiFi, where seats are in high demand. Google itself organises top quality events, but some of the guest events are pretty lamentable and only really of interest to ‘newbies’ (more than 40 events per week!). Google Campus is an inclusive community (with over 10,000 member entrepreneurs), so everyone is welcome.

The Start-up scene

Among the London tech stars are popular brands such as flight-booking Skyscanner and food-delivery giant Just-Eat (moved from Sweden). Other stars like Mind Candy, mobile taxi app Hailo Cab and holiday rental site Housetrip are considering an IPO.

Being located in the financial capital of Europe vets the dealflow for start-ups: Uniplaces (renting) secured £700,000 in seed funding, Move Guides (staff relocation) raised $1.8M seed funding, Zomato (restaurant reviews) closed its fifth round of funding with $37M, Ruffl (restaurant booking) secured £1M in seed, Unbound (publishing) secured £1.2M , Depop raised $1M in seed and Datashift (social media marketing) raised $42M. Other start-ups such as Kano (coding-kit for kids) raised $1.2M on Kickstarter.

Another side-effect of London as a financial services hotspot are the favourable conditions for FinTech start-ups: Wonga, OpenGamma, Nutmeg, GoCardless, TransferWise, Zopa and Duedil are leveraging that opportunity. Crowdfunding platform Seedrs announced this month that it will open up to startups from all over Europe.

Some start-ups already had a nice exit deal such as lastminute.com ($1.1B), Tweetdeck ($40M), last.fm ($280M) and Lovefilm ($317M). A number of high-growth start-ups were snapped up in 2013, including Summly (Yahoo!), Mendeley (Reed-Elsevier) and recently delivery-service Shutl (eBay).

A new generation of promising start-ups such as Masabi (ticketing), Swiftkey (keyboards), import.io (data factory), Hassle (cleaners), Signkick (advertising), Qubit (big data) and YPlan (nightlife) are believed to reach £100M in revenue within 3 to 5 years.

Other upcoming 800-pound gorillas are struq (advertisement), Lovestruck (dating), moo.com (printing), Qriously (advertising), Huddle (content collaboration), Songkick (news), Badoo (dating) and conversocial (customer service).

Social network and dealsaver start-up F6S is focusing on deals for start-ups and processed +$100M deals to date. Among its backers are high profile tech enablers such as Google, rackspace and Stripe.

Also good news for Tech City is the arrival of Chinese tech companies. Starting with mobile gaming giant Rekoo setting-up a 10 employees beachhead in London. It works also the other way around: London based Memsire is launching an app in China, the largest smartphone market in the world, so Chinese learn Oxford Cambridge English.

Accelerators

Launched in 2007, Seedcamp is Europe’s most successful accelerator programme. It invests €50,000 per start-up in exchange for 8-10% of the shares. It also offers a co-working space, an intensive mentoring programme, a field trip to the US and a raft of discounts on all sorts of useful (and not-so-useful) services. Clearly, this is an accelerator with deep pockets. Unlike most accelerators, which tend to be set up by business angels, the bulk of Seedcamp’s funding comes from VCs, initially the Swiss Index Ventures but also institutional investors, such as the German giant Bertelsmann Digital Media Investments. This accounts for 83% of Seedcamp alumni, who pick up average funding of €1.5 million!

Launched in 2007, Seedcamp is Europe’s most successful accelerator programme. It invests €50,000 per start-up in exchange for 8-10% of the shares. It also offers a co-working space, an intensive mentoring programme, a field trip to the US and a raft of discounts on all sorts of useful (and not-so-useful) services. Clearly, this is an accelerator with deep pockets. Unlike most accelerators, which tend to be set up by business angels, the bulk of Seedcamp’s funding comes from VCs, initially the Swiss Index Ventures but also institutional investors, such as the German giant Bertelsmann Digital Media Investments. This accounts for 83% of Seedcamp alumni, who pick up average funding of €1.5 million!

TechStars acquired a foothold in London when it took over Springboard in early 2013. Unsurprisingly, since the takeover it has seen candidate numbers quadruple. Buoyed by this initial success and in a bid to set itself apart from rival Seedcamp, TechStars decided to leave Google Campus and move to Warner Yard, the co-working space of early-stage fund Playfair Capital (and also home to Antwerp-based Hummingbird Ventures).

Wayra is the corporate accelerator of Telefónica. Since 2011 it has mainly been present in Latin American countries, but is now setting its sights on Europe with Wayra Academies in Madrid, Barcelona, Prague, Munich and Dublin. It too applies the tried-and-tested accelerator formula: 5-10% of shares in return for €40,000, six months of mentoring and office space in its new building, which has room for 20 start-ups. Wayra has come up with an ingenious solution to the problem of uncertain follow-up funding: if start-ups are unable to find external capital, they can buy their shares back from Wayra for the symbolic price of €1.

Oxygen Accelerator was based in Birmingham until last summer. As the UK’s second largest city, Birmingham seemed a great place to escape overcrowded and expensive London. But the lure of the capital proved irresistible and Oxygen has now moved into the Google Campus space vacated by TechStars. Oxygen is backed by 10 business angels. Its accelerator programme invests up to €21,000 per start-up in exchange for 8% of the shares. It also offers a co-working space and access to mentors who prepare start-ups for demo & pitch days.

All four of the above accelerators have been given permission by the UK government to issue visas to entrepreneurs from outside the European Union.

As there are plenty of accelerators active in and around London we will highlight some of them that stand out because of their specific approach.

Starting with the vertical market oriented accelerators:

- The Bakery is focusing on AdTech start-ups in a later stage and claiming to bring high profile brands and clients to the table;

- With the concentration of media, film, TV and creative industries in London it’s not a surprise that there is a media accelerator: BBC Worldwide Labs ran by Auntie BeeB;

- FinTech Innovation Lab is been run by Accenture and backed by the banks;

- Bethnal Green Ventures is for start-ups that are building solutions for social and environmental problems and;

- Healthbox is a US based healthcare focused accelerator that launched a branch last year in London.

Makeshift is a variation on the studio-model accelerator approach. They call themself a “Start-up Lab” and launched their first app, HireMyFriend, last summer with the ambition to launch many more in the months to come. One of the co-founders of Makeshift is Paul Birch. His brother Michael Birch, together with his wife Xochi Birch, sold social networking Bebo to AOL in 2008 for $850M. The couple also co-founded SF-based Monkey Inferno. Monkey Inferno calls itself a “Personal Incubator”. They recently bought back Bebo out of bankruptcy for $1M trying to revive it. Despite being a SF based start-up, Bebo was extremely popular in the UK and Ireland. Needless to say that there are a lot of similarities in approach and synergies between Makeshift and Monkey Inferno.

Makeshift is a variation on the studio-model accelerator approach. They call themself a “Start-up Lab” and launched their first app, HireMyFriend, last summer with the ambition to launch many more in the months to come. One of the co-founders of Makeshift is Paul Birch. His brother Michael Birch, together with his wife Xochi Birch, sold social networking Bebo to AOL in 2008 for $850M. The couple also co-founded SF-based Monkey Inferno. Monkey Inferno calls itself a “Personal Incubator”. They recently bought back Bebo out of bankruptcy for $1M trying to revive it. Despite being a SF based start-up, Bebo was extremely popular in the UK and Ireland. Needless to say that there are a lot of similarities in approach and synergies between Makeshift and Monkey Inferno.

The London ecosystem

As well as accelerators, London is also home to hundreds of co-working spaces, of which The Trampery, Shoreditch Works and Hub Westminster offer that little bit extra. General Assembly, the popular New York co-working-space-turned-training-institute for start-ups and entrepreneurs, even has two London bases.

London would not be London if it was not able to attract the capital needed for all these start-ups. It boasts large numbers of high-profile VCs, including Atomico, Balderton Capital, Index Ventures, Advent Venture Partners, DN Capital and the transparent trendsetting Passion Capital, which has its own accelerator programme at White Bear Yard.

But early-stage funds, such as Connect Ventures and Hoxton Ventures, are also prominent players in the city. KPMG has recently announced a $100M investment fund, focussing on data and analytics companies. Tech City itself has established a programme called Future Fifty to prepare 50 high-growth companies for flotation on the London Stock Exchange.

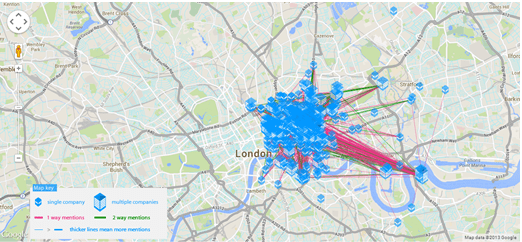

For a visual overview of the London ecosystem, see www.techcitymap.com

Silicon Roundabout, also known as Tech City, can be accessed via Old Street Underground station, just two stops from St Pancras International, where Eurostar trains from Brussels and Paris arrive into London.

The Cambridge phenomenon

Hardware start-ups are concentrated in Cambridge, an hour’s journey from London. Cambridge was actually the first ‘Tech City’ in the UK nicknamed Silicon Fen or the Cambridge cluster. It boasts +1.000 start-ups, 10 companies worth over $1 billion and two valued at more than $10 billion (ARM and Autonomy). The fact that Cambridge, for all its prestige and history, has been rapidly overtaken by London proves that an ecosystem requires more than just a university campus and a science park.